OUR SECTORS

AGRICULTURE

AUTOMOBILE

CHEMICAL

CONSTRUCTION

DAIRY

ELECTRONICS

FINANCIAL

F.M.G.C.

FOOD PROCESSING

FRANCHISING INDUSTRY

FURNISHING

HEALTHCARE

INDUSTRIAL PARK

INFORMATION TECHNOLOGY

JEWELLERY

MODERN TECHNOLOGY

RENEWABLE INDUSTRY

SANITARYWARE

INCUBATION & STARTUPS

TEXTILE & GARMENTS

WAREHOUSE

WELLNESS

© 2015 - 2025. All Rights Reserved

AGRICULTURAL INDUSTRY

Growth of the industry over the years

The agriculture industry represents an important component of the Indian economy both in terms of its contribution to the GDP as well as a source of employment to the majority of the country’s population. Over the past few years, India’s GDP has been growing at a steady pace which has resulted in a rise in the disposable incomes of the consumers.

This rise has driven the agriculture market both in terms of the producer and consumer. The agriculture industry in India reached a value of INR 56,564 Billion in 2019. Various physical factors like climate, soil, topography and non-physical factors like technological development, infrastructural facilities and new policies helped in the growth of the industry.

Government Policies & FDI Investments

The government of India is working relentlessly to make agriculture in India a promising sector for global investment. At present, 100% foreign direct investment (FDI) is allowed through the automatic route into India for the following agricultural activities: • Floriculture, horticulture, apiculture and cultivation of vegetables and mushrooms under controlled conditions • Development and production of seeds and planting material • Animal husbandry (including breeding of dogs), fish farming, aquaculture, under controlled conditions • Services related to agriculture and its allied sectors Other than these activities, foreign investments of up to 100% under the government route are permitted in the tea sector, including tea plantations.

Opportunities for Investors

The Indian food industry is poised for huge growth, increasing its contribution to world food trade every year due to its immense potential for value addition. The Indian food and grocery market are the world’s sixth largest, with retail contributing 70 per cent of the sales. Gross Value Added by agriculture, forestry and fishing is estimated at Rs 18.55 lakh crore (US$ 265.51 billion) in FY19 (PE).

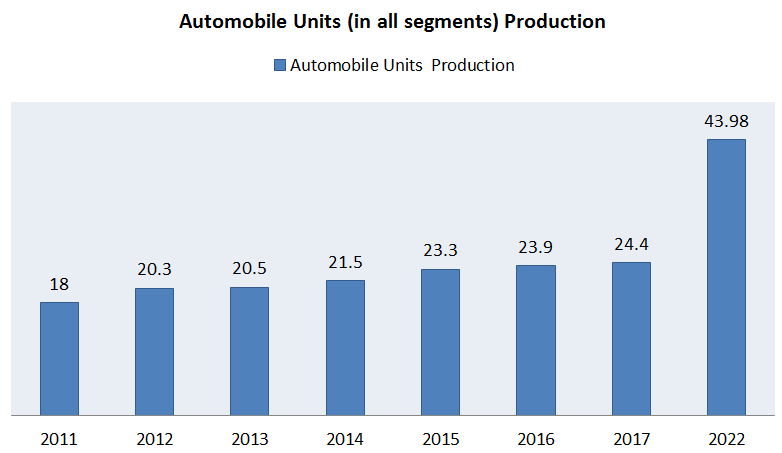

AUTOMOBILE INDUSTRY

Why Invest in India?

India is the second largest country is the world with a population of over one billion people. As a developing country, India’s economy is characterized by wage rates that are significantly lower than those in most developed countries. The basic advantages provided by India in the automobile sector include, advanced technology, cost-effectiveness, and efficient manpower.

It ranks third in manufacturing three wheelers and second in manufacturing of two wheelers. This has contributed largely in making India a prime destination for many international players in the automobile industry who wish to set up their business in India.

Future of Electric Cars in India

At a fundamental level, electric cars offer a dramatically lower operating cost compared to conventional internal combustion engines. On average, electric vehicles are 75-80% cheaper from fuel and maintenance perspective, which is an important consideration for many consumers who have high usage.

Government initiative to promote it

The Indian government is gunning for its goal of making 30% of Indian vehicles electric by 2030. The steps taken in 2019 to promote electric vehicles in the country include: 1. Special policy measures such as slashing GST on EVs to 5% versus 28% for combustion engines 2. INR 1.5 lakh tax exemption on loans to buy electric vehicles 3. INR 10K Cr allocated to FAME II to push electric mobility through standardisation 4. Union cabinet has proposed customs duty exemption on certain EV parts including electric drive assembly, on-board charger, e-compressor and a charging gun to cut down costs 5. To localise the value chain, cabinet outlaid a five-year phased manufacturing programme (PMP) until 2024 6. Nearly a dozen states either issued or proposed electric vehicle policies till date, with Delhi being the latest one. 7. The government is drawing up an incentive scheme for the autos sector aimed at doubling exports of vehicles and components in the next five years. The incentives would be based on the sales value of vehicles or components and eligible companies would need to meet certain conditions, including a minimum revenue and profit threshold and presence in at least 10 countries.

Scope for Investors in India

The increase in the demand for cars and other vehicles is powered by the increase in the levels of disposable income in India. The automobile sector in India was opened up to foreign investments in the year 1991. 100% Foreign Direct Investment (FDI) is allowed in the automobile industry. FDI is also permitted in the manufacture of auto components in India. The product you produce in India can be sold in India itself as it is a very big and growing market, besides exporting globally.

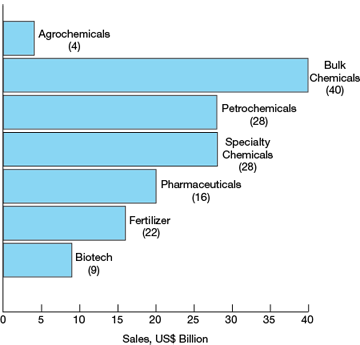

CHEMICAL & PHARMACEUTICAL INDUSTRY

Why should you invest in India?

The chemical sector has witnessed growth of 13-14% in the last 5 years while petrochemicals have registered a growth of 8-9% over the same period.

Here are some major growth drivers: • Structural advantage: With a growing market and purchasing power, the domestic industry is likely to grow at over 10-13% in the coming years. • High domestic consumption: The chemicals industry in India is the largest consumer of its own products, consuming 33% of its output. With promising growth trends in the chemicals industry, this internal consumption is also set to rise. • Diversified industry: The Indian chemicals industry has a diversified manufacturing base that produces world-class products. Further, this large and expanding domestic chemicals market also boasts of a large pool of highly-trained scientific manpower. • Promising export potential: Chemicals constitute ~5.4% of Indias total exports. India already has a strong presence in the export market in the sub-segments of dyes, pharmaceuticals and agro chemicals.

Government Policies & FDI Investments

When it comes to FDI the Government helps to facilitate it by making it 100% permissible. Manufacture of most of chemical products is de-licenced. Only Hydrocyanic acid & its derivatives ,Phosgene & its derivatives, Isocyanates & di-isocyanates of hydrocarbons needs to be covered in the compulsory licensing list because of their hazardous nature.

Opportunities for Investors

There’s a lot of scope for a flourishing business in the chemical industry especially when it comes to global companies wanting to set up their base here to earn huge profits.

CONSTRUCTION & DEVELOPMENT INDUSTRY

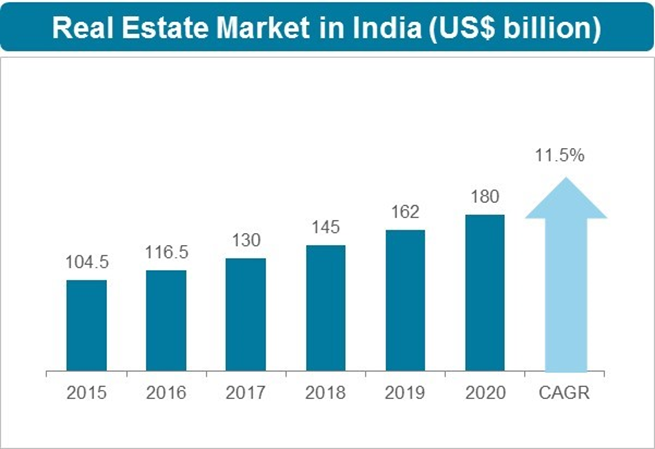

Why should you invest in India?

The Construction industry in India consists of the real estate as well as the urban development segment. The Real estate segment covers residential, office, retail, hotels and leisure parks, among others, while urban development segment broadly consists of sub-segments such as Water supply, Sanitation, Urban transport, Schools, and Healthcare.

By 2025, Construction market in the country is expected to emerge as the 3rd largest globally and the construction output is expected to grow on an average of 7.1% each year. An enhancement in the construction industry will directly have a positive effect on other industries like cement, technology, steel, etc.

FDI & India

Currently, a 100% foreign direct investment is allowed in construction-development projects, which includes development of townships, construction of commercial and residential premises, roads, or bridges, hotels, hospitals, resorts, educational institutions, recreational facilities, are allowed under the automatic route for approval. The Government of India has de-licensed the material handling equipment industry and has allowed 100% FDI under the direct route. It has also given approval to some financial institutions to raise money through tax-free bonds.

DAIRY, POULTRY FARMING & FISHERY INDUSTRY

Growth of the industry over the years

India has the largest livestock population (485 million) which represent about 55% (96 million) and 16% of the world’s buffalo and cattle populations respectively. The country ranks second in goats, third in sheep and camels, and seventh in poultry populations in the world. It has been the top producer of milk which is one of the primary produce of the livestock sector. Nearly three million tonnes of broiler meat and about 2.86 million tonnes of eggs are produced annually in India. Growing at about 20 per cent annually the domestic poultry market is currently estimated at about Rs. 49,000 crore. Indian poultry meat products have good markets in Japan, Malaysia, Indonesia and Singapore.

Government Policies & FDI Investments

At present, FDI is allowed in most aspects of dairy sector, including machines and equipment. Recently, the government relaxed norms for FDI in animal husbandry by allowing research in non-controlled conditions as well. The government is aiming to double farmers’ income by 2022 and has decided to spend Rs 110 crore this financial year under the National Programme for Dairy Development to expand milk procurement mechanism at village level for the benefit of farmers. It is also focusing on increasing the milk productivity of cows and buffaloes, for which the government has set aside Rs 104 crore for the current fiscal on breeding programme.

Opportunities for Investors

The food sector in India has successfully established its presence. India's food ecosystem offers huge opportunities for investments with stimulating growth in the food retail sector, favourable economic policies and attractive fiscal incentives. By 2020, Indian Food and Retail market is projected to touch $828.92 billion, while the dairy industry is expected to double to $140 bn.

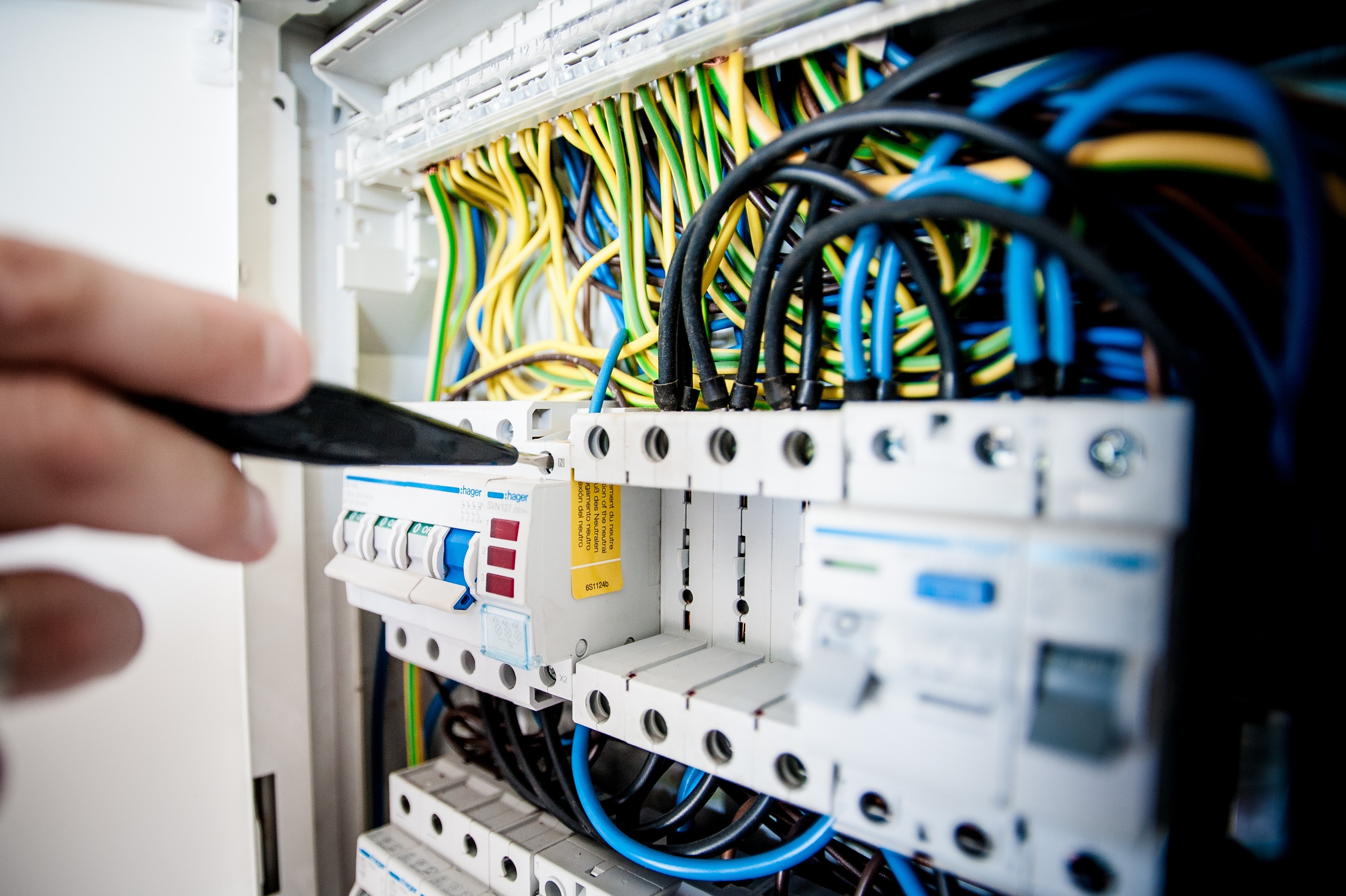

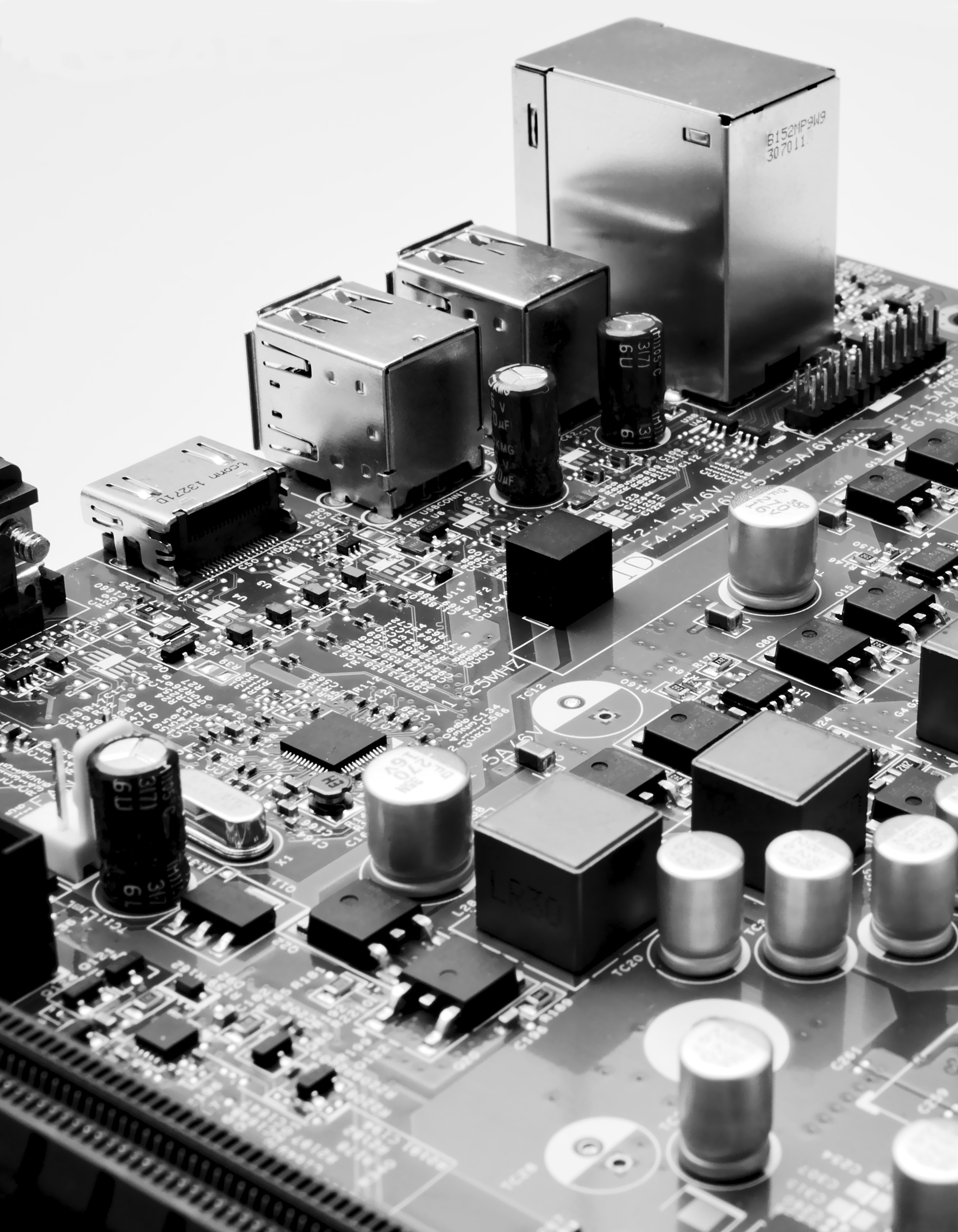

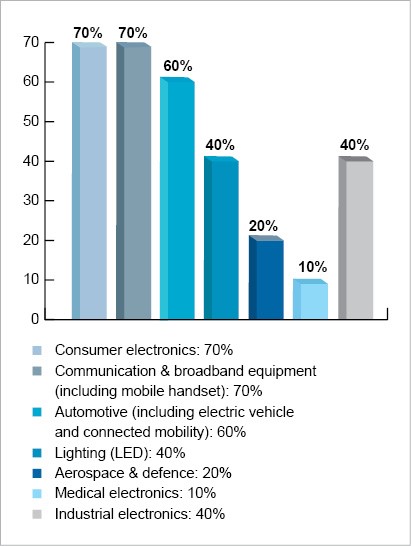

ELECTRONIC INDUSTRY

Why should you invest in India?

The electronics sector consists of consumer and industrial electronics, computers, communication and broadcasting equipment, strategic electronics, and electronic components. It is one of the largest markets in the world, and in India, from US$ 69.6 billion in 2012, it is anticipated to reach US$ 400 billion in 2022.

The industrial electronic industry consist of a variety of products like large-scale computers, radio and television broadcasting equipment, telecommunications equipment, and electronic office equipment. It is currently poised at about Rs. 340 billion. Here are few major advantages of the electronic industry in India – • Exports of industrial electronics from India reached US$ 148.90 million from April- July’19. The top export destinations were USA (US$ 39.89 million), UK (US$ 3.68 million), Singapore (US$ 10.17 million), Israel (US$ 6.91 million) and Belgium (US$ 6.10 million). India’s share in global electronics manufacturing has grown from 1.3% in 2012 to 3.0% in 2019 • The electronics manufacturing sector accounts for 2.5% of India’s GDP, and employs over 13 million people are through directly and indirect jobs. • Demand from households is set to accelerate given rising disposable incomes, changing lifestyles, and easier access to credit. • To overcome the economic slump caused by COVID -19, global electronics companies are considering shifting their manufacturing bases from China to India because of the growth potential available here.

Government Policies & FDI Investments

India welcomes investors in Electronics and IT sector as the government of India is striving to bring greater transparency in policies and procedures to provide an investor friendly platform. A foreign company can start operations in India by registration of its company under the Indian Companies Act 1956. Foreign equity in such Indian companies can be up to 100%. Various schemes and initiatives announced by the Modi-led government such as Digital India, Start-up India, NPE 2019 and many more offer a conducive environment for electronics manufacturing.

Opportunities for Investors

In general, it is to say that the prospects of the electrical as well as the electronic industry look very bright. The growing customer base and the increased penetration in the consumer durables segment have provided enough scope for the growth of the Indian electronics sector whereas the input by the Indian government will ensure the growth of the electrical machinery industry. The product you produce in India can be sold in India itself, besides exporting globally.

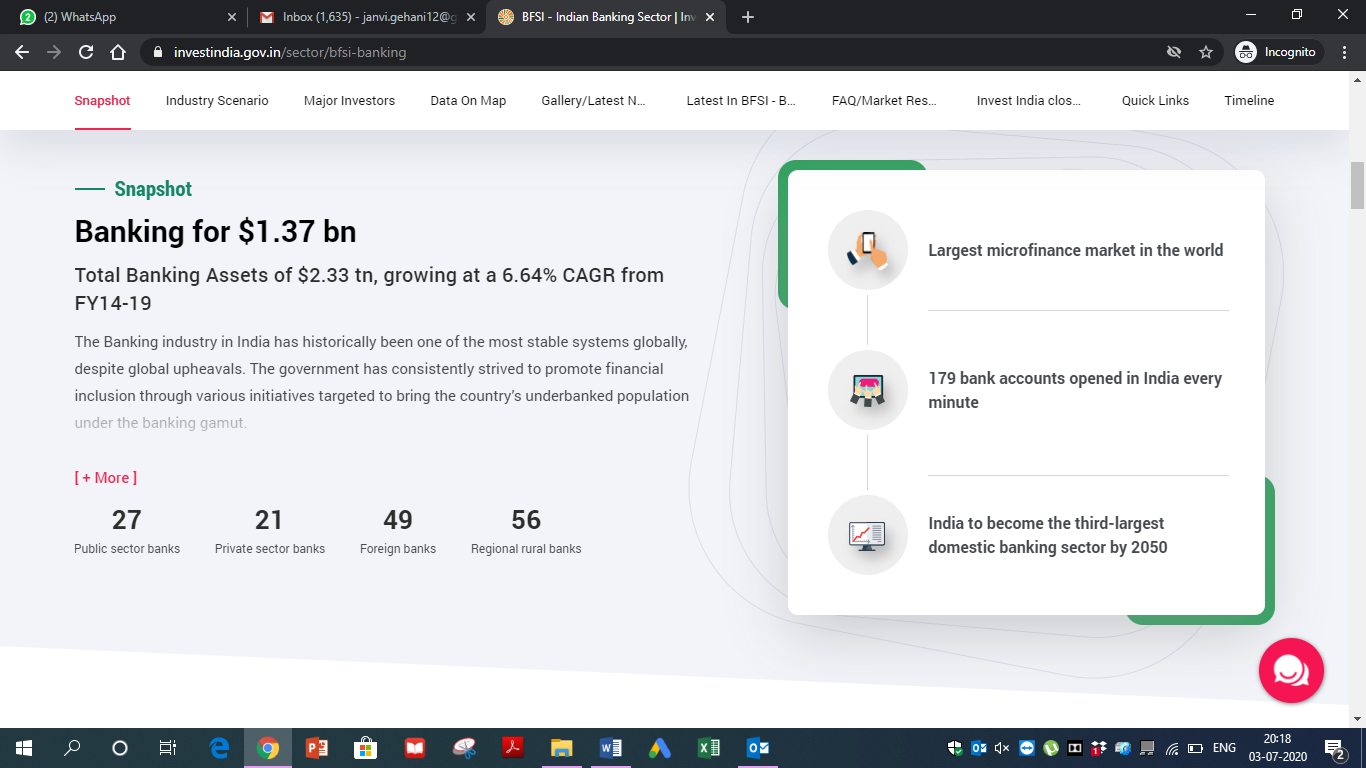

FINANCIAL SERVICE INDUSTRY

Overview on the industry

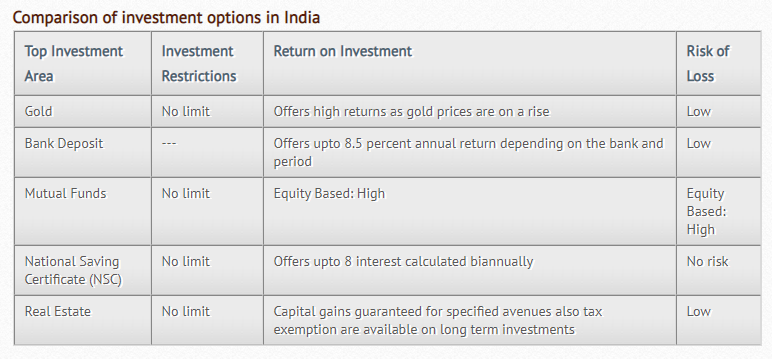

Investment is referred to as the concept of deferred consumption, which could be in the form of an asset, rendering a loan, keeping the saved funds in a bank account such that it might generate lucrative returns in the future etc. The options of investments are huge; all of them having different risk-reward trade off.

India has a diversified financial sector undergoing rapid expansion, both in terms of strong growth of existing financial services firms and new entities entering the market. The sector comprises commercial banks, insurance companies, non-banking financial companies, co-operatives, pension funds, mutual funds and other smaller financial entities.

Government Initiative & FDI Policy

FDI in this sector has been raised. 74% FDI via the automatic route is allowed in the private sector banks. This means that the aggregate foreign investment in any private bank considering all sources should be up to 74% of the paid-up capital. In the case of nationalized banks, the Portfolio and FDI investments maximum limit is 20%. This cap also applies to the investment in state banks and other associated ones. The Government of India has introduced several reforms to liberalise, regulate and enhance this industry. The Government and Reserve Bank of India (RBI) have taken various measures to facilitate easy access to finance for Micro, Small and Medium Enterprises (MSMEs). These measures include launching Credit Guarantee Fund Scheme for Micro and Small Enterprises, issuing guideline to banks regarding collateral requirements and setting up a Micro Units Development and Refinance Agency (MUDRA). Some government Initiatives taken are - • Under the Interest Subvention Scheme for MSMEs, Rs 350 crore (US$ 50.07 million) has been allocated under Union Budget 2019-20 for 2 per cent interest subvention for all GST registered MSMEs, on fresh or incremental loans. • Securities and Exchange Board of India (SEBI) proposed direct overseas listing of Indian companies and other regulatory changes. • Bombay Stock Exchange (BSE) introduced weekly futures and options contracts on Sensex 50 index from October 26, 2018. • In September 2018, SEBI asked for recommendations to strengthen rules which will enhance the overall governance standards for issuers, intermediaries or infrastructure providers in the financial market. • The Government of India launched India Post Payments Bank (IPPB), to provide every district with one branch which will help increase rural penetration. As of August 2018, two branches out of 650 branches are already operational.

Scope for Investors in India

The MF industry’s Assets Under Management (AUM) has grown from Rs 10.96 trillion (US$ 156.82 billion) in October 2014 to Rs 28.18 trillion (US$ 403.32 billion) in January 2020. Another crucial component of India’s financial industry is the insurance industry. The insurance industry has been expanding at a fast pace. The total first year premium of life insurance companies reached Rs 214,673 crore (US$ 30.72 billion) during FY19. Along with the secondary market, the market for Initial Public Offers (IPOs) has also witnessed rapid expansion. In FY19, Rs 14,674 crore (US$ 2.10 billion) has been raised from Initial Public Offerings (IPOs). Furthermore, India’s leading bourse Bombay Stock Exchange (BSE) will set up a joint venture with Ebix Inc to build a robust insurance distribution network in the country through a new distribution exchange platform. India is today one of the most vibrant global economies, on the back of robust banking and insurance sectors and it’s mobile wallet industry is estimated to grow at a Compound Annual Growth Rate (CAGR) of 150 per cent to reach US$ 4.4 billion by 2022 while mobile wallet transactions to touch Rs 32 trillion (USD $ 492.6 billion) by 2022. Overall, the Indian banking industry has immense potential for further growth and expansion

FMGC INDUSTRY

Why should you invest in India?

The Fast-moving consumer goods (FMCG) sector is the 4th largest sector of the Indian economy. There are three main segments in the sector – food and beverages, which accounts for 19 per cent of the sector; healthcare, which accounts for 31 per cent of the share; and household and personal care, which accounts for the remaining 50 per cent share.

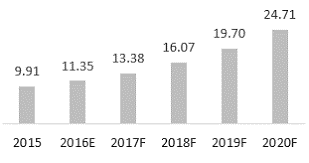

Products that dominate the market today are detergents, toiletries, tooth cleaning products, cosmetics, etc. The FMCG sector in India also includes pharmaceuticals, consumer electronics, soft drinks packaged food products and chocolates. In 2019-2020, this sector recorded a market size of $ 24.71 bn. India’s demographic profile plays a major role in the growth of this sector. As consumption in India grows at an unprecedented rate, the FMCG industry remains a key sector for investors. There is also a surge in interest from brands to make products like televisions, air-conditioners, microwave ovens, shoes, speakers, ear phones, set-top boxes and apparel in the country as companies fear consumer backlash against 'Made in China' products and expects surge in import duties by the government as a retaliatory step against China due to the Galwan crisis.

Government Policies & FDI Investments

The government has allowed 100 per cent Foreign Direct Investment (FDI) in food processing and single-brand retail and 51 per cent in multi-brand retail. This would bolster employment and supply chains, and also provide high visibility for FMCG brands in organised retail markets, bolstering consumer spending and encouraging more product launches. Some of the major initiatives taken by the government to promote the FMCG sector in India are as follows: • The Government of India has drafted a new Consumer Protection Bill with special emphasis on setting up an extensive mechanism to ensure simple, speedy, accessible, affordable and timely delivery of justice to consumers. • The Goods and Services Tax (GST) is beneficial for the FMCG industry as many of the FMCG products such as Soap, Toothpaste and Hair oil now come under 18 per cent tax bracket against the previous 23-24 per cent rate. Also rates on food products and hygiene products have been reduced to 0-5 per cent and 12-18 per cent respectively. The GST is expected to transform logistics in the FMCG sector into a modern and efficient model as all major corporations are remodelling their operations into larger logistics and warehousing.

Opportunities for Investors

The market in India has grown from US$ 840 billion in 2017 and is estimated to reach US$ 1.1 trillion by 2022. It has a growth of 20 %- 25% per annum, which is likely to boost revenues of FMCG companies. Revenues of FMCG sector reached Rs 3.4 lakh crore (US$ 52.75 billion) in FY19 and are estimated to reach US$ 103.7 billion in 2022. It is safe to say that this is the best time to invest in the country as it has great expectations of growth, especially because of the available opportunities due to the outbreak of COVID-19. The product you produce in India can be sold in India itself as it is a very big and growing market, besides exporting globally.

FOOD PROCESSING INDUSTRY

Growth of the industry over the years.

The Indian food and grocery market is the world’s sixth largest, with retail contributing 70 per cent of the sales. The Indian food processing industry accounts for 32 per cent of the country’s total food market, one of the largest industries in India and is ranked fifth in terms of production, consumption, export and expected growth.

The Indian gourmet food market is currently valued at US$ 1.3 billion and is growing at a Compound Annual Growth Rate (CAGR) of 20 per cent. India's organic food market is expected to increase by three times by the year 2022.

Government Policies & FDI Investments

100% FDI is allowed through government approval route for trading, including through e-commerce in respect to the food processing industry in India. Some of the major initiatives taken by the Government are – • The Food Safety and Standards Authority of India (FSSAI) plans to invest around Rs. 482 crore (US$ 72.3 million) to strengthen the food testing infrastructure in India. • The Indian Council for Fertilizer and Nutrient Research (ICFNR) will adopt international best practices for research in fertiliser sector, which will enable farmers to get good quality fertilisers at affordable rates. • The Ministry of Food Processing Industries announced a scheme for Human Resource Development (HRD) in the food processing sector. They are as follow - 1. Creation of infrastructure facilities for degree/diploma courses in food processing sector 2. Entrepreneurship Development Programme (EDP) 3. Food Processing Training Centres (FPTC) 4. Training at recognised institutions at State/National level

Opportunities for Investors

The Indian food industry is poised for huge growth, increasing its contribution to world food trade every year. In India, the food sector has emerged as a high-growth and high-profit sector due to its immense potential for value addition, particularly within the food processing industry. Food & Grocery retail market in India further constitutes almost 65% of the total retail market in India.

FRANCHISING INDUSTRY

Overview on the industry

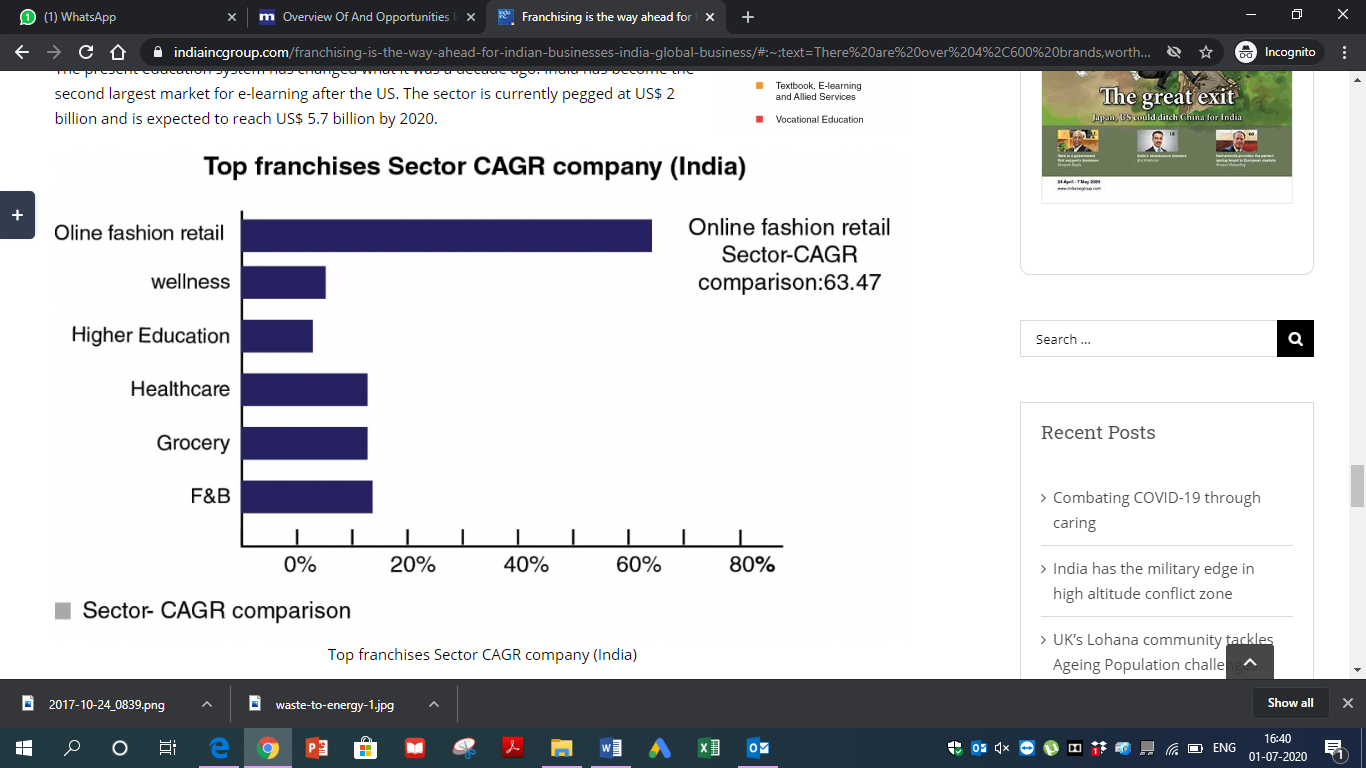

There are 4,600 franchisors in India with 50% Regional Brands, 34% national and 16% global Brands in franchising sector in India India has about 2lakh franchise stores operated by almost 1.7 lakh franchisees. States in the South and West region of India continue to lead the nation in franchise employment and output growth in 2019. Here is a list of top franchising sectors in the country –

Approximately 1.5 million people are employed by franchised businesses over the past 20 years as India has been a major hotspot for international brands. Some of the international brands that operate in India through franchisees include Anytime Fitness, Baskin-Robbins, Burger King, Domino's, Dunkin', Gold's Gym, Johnny Rockets, KFC, Krispy Kreme, McDonald's, Pizza Hut, RE/MAX, Subway, and Toni & Guy and made huge profits in the market. Brand licensing in India is getting to a point where we are witnessing a lot more maturity in the way it is shaping as compared to what it was a decade ago. The Indian licensing and merchandising industry is pegged at $1476 million and is expected to grow at a fast pace, credits to the influx of global as well as home-grown IPs.

Government Policies & FDI Investments

Currently, the FDI policy allows for up to 100% FDI in single-brand retail and up to 51% FDI in multi-brand retail. Further, the government has taken steps to remove barriers to FDI in a range of sectors, including: (a) 100% FDI in aviation, telecoms, asset reconstruction companies, and courier services; (b) 74% FDI in credit information companies; and (c) 49% FDI in power exchanges, stock and commodity exchanges, and depositories. PM Modis foreign policy is primarily focussing on improving relations with neighbouring countries and getting the world to invest in India. They are planning to reform India’s economy through major reforms in the manufacturing and export sector. It has not only increased the limits of FDI but also encouraged privatization of loss-making public sector companies.

Scope for Investors in India

The economy is also very receptive to new business opportunities due to factors such as high disposable income, high entrepreneurial energy, growing urban population etc. and franchising has become the way forward for growth and distribution of Products and servicesacross industries. Currently India is one of the fastest growing large economies of the world with amongst the youngest populations at an average age of 29 years. There are over 4,600 brands currently in India that are growing through franchise route and it is the way ahead for businesses to grow.

FURNISHING INDUSTRY

Overview on the industry

The boom in the residential real estate industry over the last few decades has given an impetus to the home décor market. Also driving the growth of this section is an increased consciousness among home owners for stylish interiors and beautiful indoors. India Home Furnishing Market consist of products like Curtain Fabric, Upholstery, Bed Linen, Bath Linen, Kitchen Linen, Table Linen, Quilts/Blankets, Wallpapers, Blinds, Rugs and Carpets, and Other Made-ups

The factors which are propelling the growth of Furnishing sector - – People have started taking their home as the reflection of themselves and so, a lot of people are now spending more on furnishing products. – Disposable income, better education and also the growing trend of individuals opting for professional services to do their interiors have together led to a rise in this category. – Indians are well travelled now and have an exposure to lifestyles in other countries, this inspires them to have a similar lifestyle for themselves too. India is one of the fastest growing markets for home furnishing products in Asia-Pacific. Rising demand for home decor products such as bed linen products, wall hangings, rugs & carpets, etc., along with growing demand for handcrafted products is boosting the country’s home furnishing market.

FDI Investments Policy

The Indian government has come up with a number of export promotion policies for this sector and has also allowed 100 per cent FDI under the automatic route. Government initiatives such as handicraft schemes, Technology Upgradation Fund Scheme (TUFS), integrated textile parks, etc., help in boosting the growth of this industry.

Scope for Investors in India

Rising domestic production of home furnishing products along with increasing number of government initiatives fuel growth in India home furnishing market through 2022. Home furnishing market in the country is projected to grow at a CAGR over 8% during 2020 - 2022. Growing trend of custom designed furniture, growth in housing and real estate sectors, rising adoption of eco-friendly products and increasing demand for wallpapers, blinds, etc., is expected to continue driving home furnishing market in the country. The high abundance of raw materials coupled with cheap labour costs and low cost of manufacturing makes it a favourable country for investors to earn huge profits

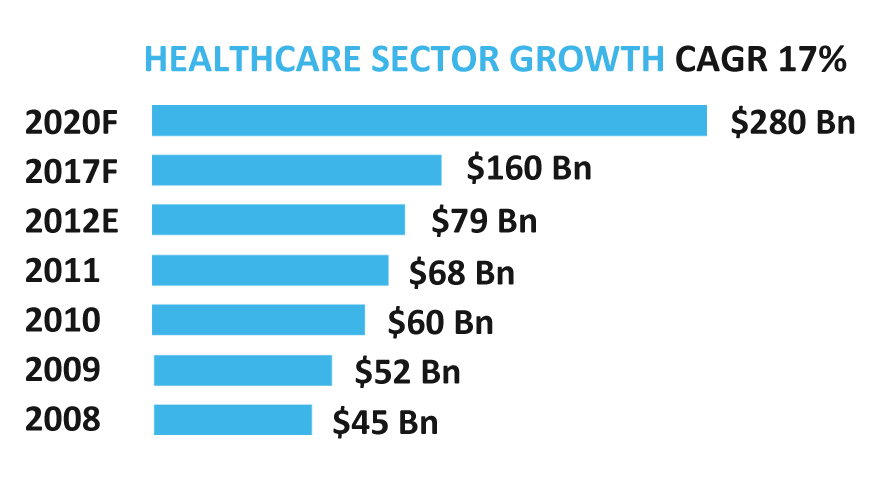

HEALTHCARE INDUSTRY

Why should you invest in India?

Healthcare has become one of India’s largest sectors - both in terms of revenue and employment. Healthcare comprises hospitals, medical devices, clinical trials, outsourcing, telemedicine, medical tourism, health insurance and medical equipment. The Indian healthcare sector is growing at a brisk pace due to its strengthening coverage, services and increasing expenditure by public as well private players.

Indian medical tourism market is growing at the rate of 18 per cent year on year and is expected to reach US$ 9 billion by 2022. Owing to the rising income levels, more and more consumers willingly demand access to quality healthcare facilities. Moreover, easy access to medical insurance has further contributed positively to the affordability of healthcare and related services. The Covid-19 outbreak has provided the industry with a unique opportunity. There is a possibility of the world focus shifting from China to India as the primary producer and supplier of APIs, IVDs and generic drug, provided we are prudent enough to act fast and cash in on the situation. India has the potential to become the alternative supplier to global drug manufacturers replacing China due to growing distrust and possible sanctions against them.

Government Policies & FDI Investments

100% FDI in healthcare sector in India is allowed under the automatic route for green-field projects. Also, for the brown-field projects, 100% FDI is permitted under the government route. The Government’s expenditure on the health sector has grown to 1.6 per cent of the GDP (Gross Domestic Product) in FY20 from 1.3 per cent in FY16. The Government is planning to increase its public health spending to 2.5 per cent of the country's GDP by 2025. Healthcare’s share of GDP is expected to rise by 19.7 per cent by 2027. The government has significantly contributed to the growth of the private sector. To add to the fact, the Indian Government had subsidized private sector organizations by providing low rates for hospital establishments and giving exemptions from taxes and duties for imported medical equipment and drugs.

Opportunities for Investors

Growing incidence of lifestyle diseases, rising demand for affordable healthcare delivery systems due to the increasing healthcare costs, technological advancements, the emergence of telemedicine, rapid health insurance penetration and government initiatives like e-health together with tax benefits and incentives are driving healthcare market in India. Health insurance is gaining momentum in India. It grew at 14.70 % i.e. Rs. 42,328.18 crore (US$ 6.06 billion) in FY20 (up to January 2020). The market can increase three-fold to Rs 8.6 trillion (US$ 133.44 billion) by 2022.

INDUSTRIAL PARK

Overview on the industry

Industrial Parks is referred to as “self-contained island providing high-quality infrastructural facilities. It offer industrial, residential, and commercial areas with developed plots/ pre-built factories, power, telecom, water and other social infrastructure”. It is an industry that benefits everyone like – Stakeholders Benefits offered For Users - 1) Availability of high quality infrastructure in a centralised manner for the end-user industries resulting in lower transaction costs and shorter start-up time for them. 2) Economies of scale in terms of development of land and infrastructure, including common facilities. For the State: 1) Macroeconomic benefits like, increase in industrial development, growth of hinterland, etc. 2) Geographical spread of industrial development including development of backward areas. 3) Fulfilment of state’s social objectives like generation of employment, creation of social infrastructure, etc. 4) Revenues generated by the government through taxes and duties. For the Developer / Operator: 1) Commercial returns received by the park developer, operator and utility provider. There are over 3,000 industrial parks in the country in sectors including engineering, software, food processing and chemicals. The key features of the industrial parks development in India are: • Status of the industrial parks sector varies from State to State, wherein states like Maharashtra, Gujarat, AP, Tamil Nadu, etc. have made significant progress in promoting industrial parks / estates. • The approaches relating to development, administration, regulation, etc. of industrial parks also vary according to the political and developmental compulsions faced by the individual States. • Primarily, the industrial parks have been promoted by the government and its agencies but a few examples of the private initiative in industrial parks development are 1. Information Technology Park (ITPL), 2. Bangalore; Infocity, 3. Hyderabad; Technopark. 4. The Mahindra City at Chennai was envisaged initially as an Auto Park. However, over a period of time, the concept was changed and the park started focussing on IT and ITeS.

FDI Policy

The Government promotes FDI in the sector of Industrial parks by allowing 100% FDI through the automatic route.

Scope for Investors in India

Industrial parks will play a major role in the growth of the industrial sector in India, which will ensure a rapid growth in the country's GDP as it is a huge step towards enhancing industrial competitiveness. The System aims to provide important information regarding all Special Economic Zones, Industrial Clusters and Parks. It is safe to say that this is the best time to invest in as there is abundance of raw materials coupled with cheap labour costs and low cost of manufacturing makes it a favourable country for investors to earn huge profits. The product you produce in India can be sold in India itself as it is a very big and growing market, besides exporting globally.

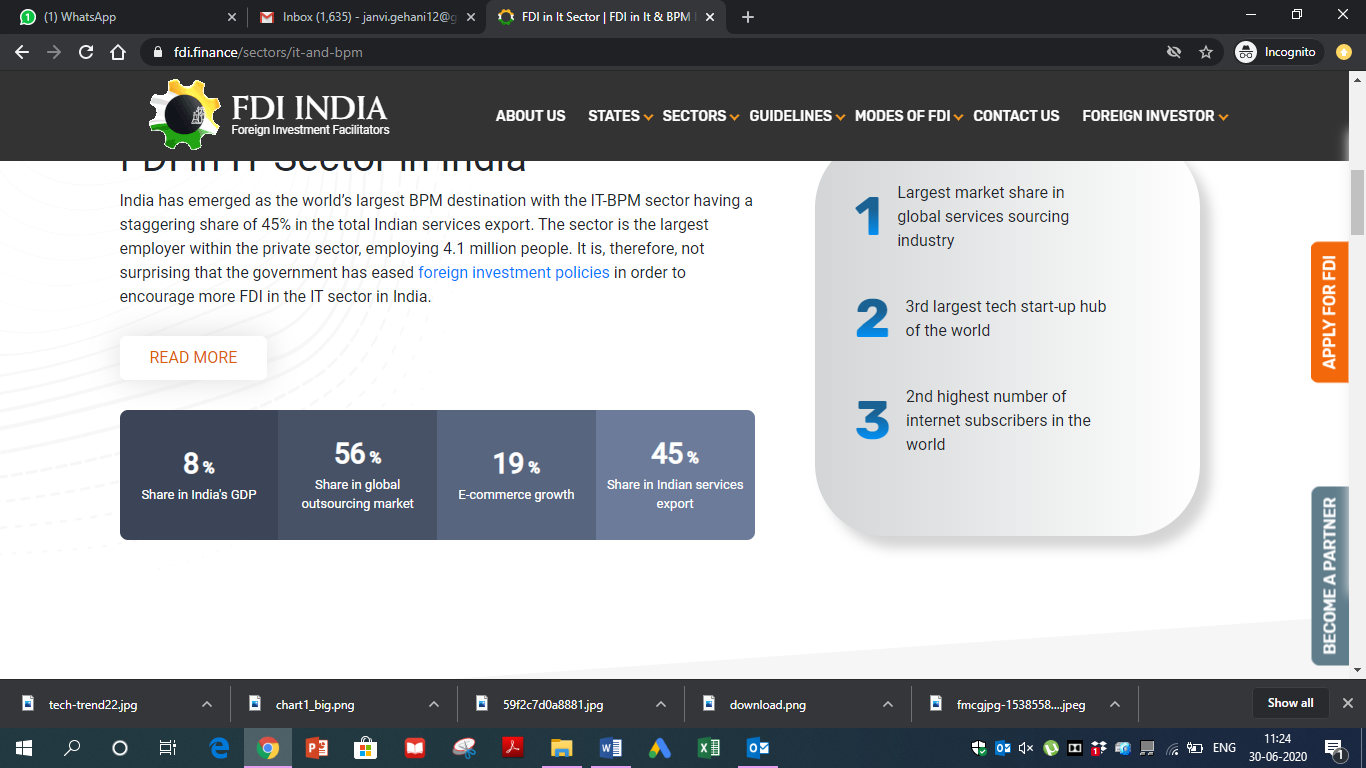

INFORMATION TECHNOLOGY INDUSTRY

Growth of the Industry over the years

Information technology refers to a broad term spectrum comprising of new communication and computing technologies. Computer hardware, software and internet are keys to the systems, designed, developed and managed by information technology professionals. The last decade of 20th century has witnessed information technology to have revolutionary effect on the lives of people. During this period, Indian engineers and scientists have earned high degree of esteem around the world for their highly professional and innovative contributions. Developed countries like USA, Germany and Japan have shown keen interest, in hiring Indian software professionals in their information technology sector.

In the technology driven start-ups, India ranks third in the world. The industry offers a range of services, from low-end application development to high-end integrated IT solutions across multiple verticals, with a well-developed vendor base. The IT-BPM sector in India stood at US$177 billion in 2019 witnessing a growth of 6.1 per cent year-on-year and is estimated that the size of the industry will grow to US$ 350 billion by 2025. India’s IT & ITeS industry grew to US$ 181 billion in 2018-19. Exports from the industry increased to US$ 137 billion in FY19 while domestic revenues (including hardware) advanced to US$ 44 billion. IT industry employees 4.1 million people as of FY19.

Government Policies & FDI Investments

As per Indian government recent FDI polices, up to 100 percent FDI is permitted under the automatic route in data processing, software development and computer consultancy services, software supply services, business and management consultancy services, market research services, technical testing and analysis services. The government has identified Information Technology as one of 12 champion service sectors for which an action plan is being developed. Also, the government has set up a Rs 5,000 crore (US$ 745.82 million) fund for realising the potential of these champion service sectors.

Opportunities for Investors

The Indian IT & software industry adheres to quality processes and standards, with most companies aligning operations with international standards. Software technology parks and special economic zones in India provide an affordable real estate space for IT companies. The product you produce in India can be sold in India itself, besides exporting globally because of its huge consumer market which is very profitable. India’s cost competitiveness in providing IT services which is one of the biggest advantages, is approximately three to four times cheaper than the US, continues to be the mainstay of its unique selling proposition (USP) in the global sourcing market.

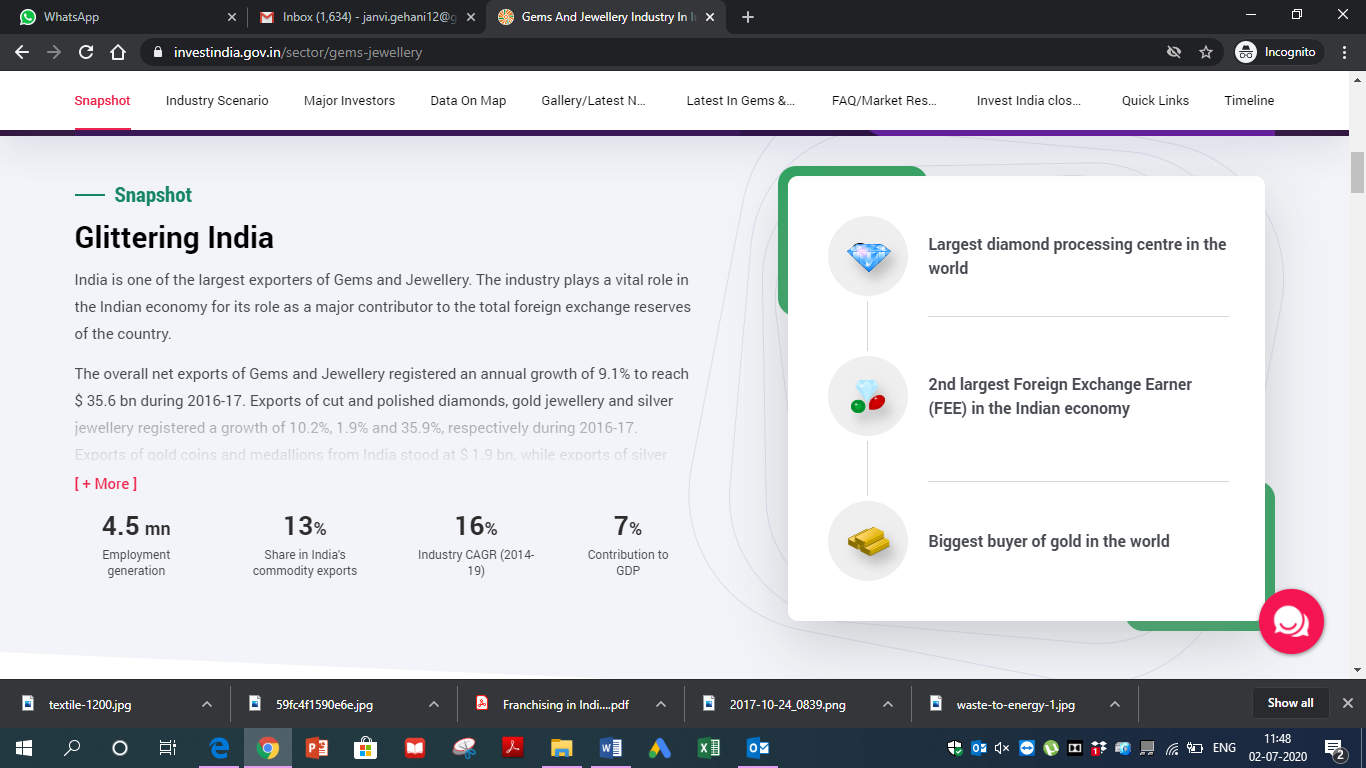

JEWELLERY & GEMS INDUSTRY

Overview on the industry

India gems and jewellery market has been categorized into gold, diamond in gold, gemstones, diamond, silver and others. It is the largest consumer of gold in the world. Rising middle class population and increasing income levels are key drivers behind the demand of gold and other jewellery in India. India’s demand for gold reached 690.4 tonnes in 2019. This sector has been one of the largest in the world, contributing around 29 per cent to the global jewellery consumption. It is home to more than 300,000 gems and jewellery players, contributing about seven per cent to India’s Gross Domestic Product (GDP) and employing over 4.64 million employees.

India is also the largest centre for cut and polished diamonds and export 75 per cent of the world’s polished diamonds. Today, 14 out of the 15 diamonds sold in the world are either polished or cut in India. India exported US$ 18.66 billion worth of cut and polished diamonds in FY20P. It contributed 64 per cent of the total gems and jewellery export.

Government Policies & FDI Investments

The Government has permitted 100 per cent Foreign Direct Investment (FDI) in the sector under the automatic route. Some initiatives taken by the government are - A jewellery park worth Rs 50 crore (US$ 7.8 million) is to be set up in Mumbai where local handmade workers and factories will be relocated to develop their trade, improve their work environment and standard of living. • It has launched the Sovereign Gold Bond Scheme. This scheme enables the Reserve Bank of India (RBI) to issue gold bonds denominated in grams of gold individuals in consultation with Ministry of Finance. • The designated banks accept gold deposits under the Short Term (1-3 Years) Bank Deposit as well as Medium (5-7 years) and long (12-15 years) Term Government Deposit Schemes.

Scope for Investors in India

Demand for gems and jewellery in India is predominantly concentrated in the southern region. South India gems and jewellery market is likely to register growth over the course of next five years, primarily owing to the presence of a large number of market players and aggressive marketing strategies adopted by companies. Gems and Jewellery sector is full of opportunities in the coming years as demand in India for gold will never end and as middle class population income increases. As income rises, so does saving and Indians prefer to buy gold with their saving as they consider gold as an auspicious and important part of investment. Also, during festivals like Diwali and Dhanteras as well as during weddings and other significant celebrations, people in India tend to spend a considerable amount of money in gems and jewellery especially in gold, all of which are expected to drive demand of gold in the future.

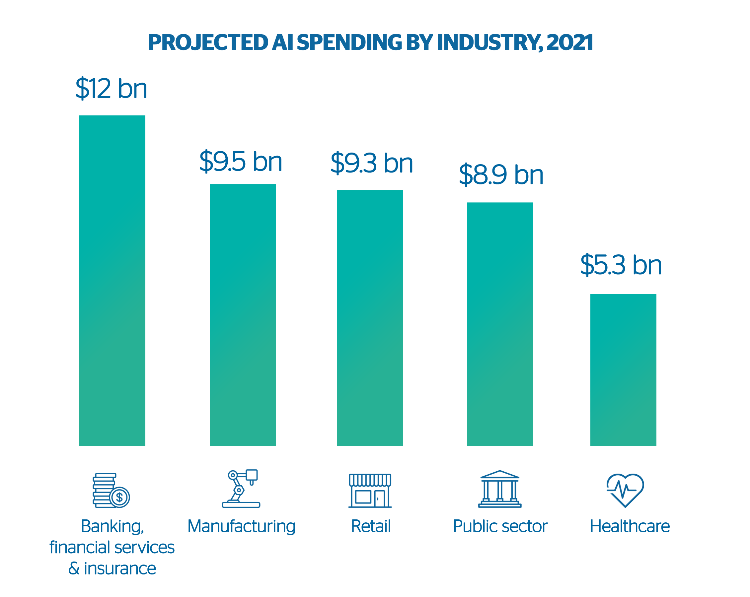

MODERN TECHNOLOGY INDUSTRY

Overview on the industry

IoT market in India is currently growing & reach USD 15 Billion by the year 2020 will grow to USD 75 Billion by the year 2025. The growth is currently driven by industrial automation, primarily in sectors like Telecom, healthcare, housing, agriculture and engineering, however, the Consumer IoT market is slowly evolving with increasing awareness among people. It is the next wave of the industrial revolution crucial to government, businesses and consumers, transforming all sectors including automation, manufacturing, agriculture, automotive, consumer electronics, energy and utilities, healthcare, home automation, infrastructure, etc. With smart cities, smart homes, smart infrastructure, smart wearable devices, autonomous and connected vehicles, etc., consumers are witnessing an Internet beyond desktops and mobile devices.

Globally, India ranks third, right behind China and the US, in terms of penetration of AI skills. About USD 150 million is invested in India’s AI sector. Even the civil aviation industry in India has emerged as one of the fastest growing industries in the country during the last three years. India is currently considered the third largest domestic civil aviation market in the world. India has become the third largest domestic aviation market in the world and is expected to overtake UK to become the third largest air passenger.

Government Policies & FDI Investments

The Government has taken various effective steps to simplify the Foreign Direct investment policy. And in the recent times many activities have been transferred to unrestricted sectors in which 100% Foreign Direct investment is permitted. The Prime Minister Narendra Modi has hailed AI as the new hope for all Indians, as it can solve problems, and increase productivity. NITI Aayog, the nation’s think-tank and premier policy-making body, has already been emphasising the role that disruptive technologies such as AI, digital manufacturing, robotics, Quantum communication and Big Data intelligence, Block chain, Machine Learning and Internet of Things will play in the development of the economy. The government has taken initiative and framed a draft policy to full-fill a vision of developing a connected, secure and a smart system based on our country’s needs.

Opportunities for Investors

Artificial Intelligence (AI) also holds a potential to add US$ 957 billion to the Indian economy by changing the nature of work to create better outcomes for businesses and society. Thereby increasing its yearly growth rate of Gross Value Added (GVA) by 1.3 percentage points, and also boosting the nation’s income by 15 percent in 2035. India ranks amongst the top ten countries to be using industrial robotics in the industry and also have a significant potential opportunity to cater to the coming demand for data cleaning and human-augmented AI training in the service sector (call centres, BPOs, etc – roughly 18% of the Indian GDP) Even the Indian aviation industry is largely untapped with huge growth opportunities, considering that air transport is still expensive for majority of the countrys population, of which nearly 40 per cent is the upwardly mobile middle class. The modern technology industry is in for a huge growth with so many untapped opportunities available

RENEWABLE ENERGY INDUSTRY

Overview on the industry

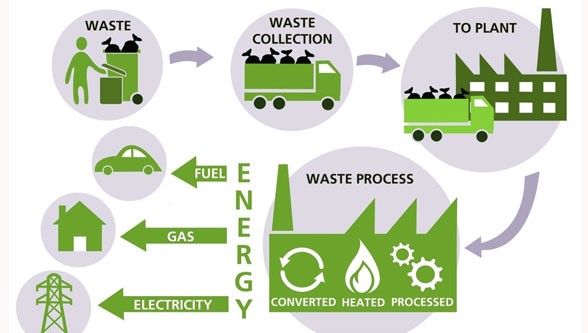

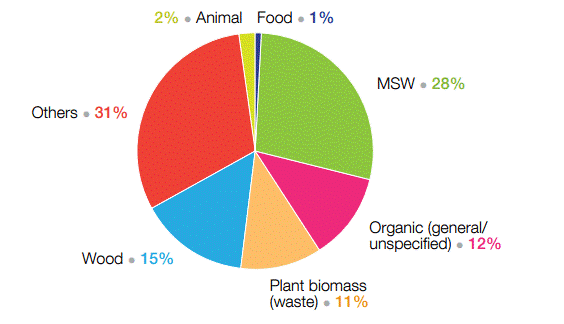

India was the first country in the world to set up a ministry of non-conventional energy resources, in early 1980s. The Indian renewable energy sector is the fourth most attractive1 renewable energy market in the world. India is ranked fourth in wind power, fifth in solar power and fifth in renewable power installed capacity as of 2019. It is also ranked second among the emerging economies to lead to transition to clean energy. Here are the latest waste-to-energy technologies available -

India accounts for approximately 4 per cent of the total global electricity generation and contributes 4.43 per cent to the global renewable generation capacity. More than USD 42 billion has been invested in India's renewable energy sector since 2014. New investments in clean energy in the country reached USD 11.1 billion in 2018. Indias generation capacity will have to increase up to seven times the present figure to meet our growth needs in the near future.

Government initiative to promote the industry

The Government of India has set an ambitious target of achieving 175 GW of renewable energy capacity by 2022. These include 100 GW of solar capacity addition and 60 GW of wind power capacity. Government plans to establish renewable energy capacity of 500 GW by 2030. Some initiatives by the Government of India to boost the Indian renewable energy sector are as follows: • India plans to add 30 GW of renewable energy capacity along a desert on its western border such as Gujarat and Rajasthan. • Delhi government decided to shut down thermal power plant in Rajghat and develop it into 5,000 KW solar park • A new Hydropower policy for 2018-28 has been drafted for the growth of hydro projects in the country. • The Government of India has announced plans to implement a US$ 238 million National Mission on advanced ultra-supercritical technologies for cleaner coal utilisation. • The Ministry of New and Renewable Energy (MNRE) has decided to provide custom and excise duty benefits to the solar rooftop sector, which in turn will lower the cost of setting up as well as generate power, thus boosting growth. • The Indian Railways is taking increased efforts through sustained energy efficient measures and maximum use of clean fuel to cut down emission level by 33 per cent by 2030.

Scope for Investors in India

India has tremendous energy needs and an increasing difficulty in meeting those needs through traditional means of power generation and for this, renewable energy programme will be used largely. Newer renewable electricity sources are targeted to grow massively by 2022, including a more than doubling of India’s large wind power capacity and an almost 15 fold increase in solar power. Such ambitious targets would place India amongst the world leaders in renewable energy use and place India at the centre of its International Solar Alliance project promoting the growth and development of solar power internationally to over 120 countries. India is one of the sun’s most favoured nations, blessed with about 5,000 TWh of solar insolation every year. Even if a tenth of this potential was utilized, it could mark the end of India’s power problems – by using the countrys deserts and farm land to construct solar plants. Electricity consumption in India has been increasing at one of the fastest rates in the world due to population growth and economic development and with the increased support of government and improved economics, the sector will become attractive from investors perspective.

SANITARYWARE INDUSTRY

Overview on the industry

The Indian sanitaryware market is divided into two sub-categories; organised and unorganised market, both in terms of value and volume. The unorganised players manufacture sanitaryware items largely with the use of conventional technology and cater mostly to the mass market with a focus on low-income strata group. On the other hand, organised players employ the latest world-class technologies for production and mainly serve the people with mid income, premium market and super-premium segment. Over the past few years, bathrooms incorporate functionality along with convenience and have started to reflect the lifestyle of a person. In order to enhance the appearance of bathrooms, the demand for tiles, sanitary ware and bathroom fittings has proliferated across the country. These products are also undergoing rapid transformation due to numerous innovations in the industry.

The Indian tiles, sanitary ware and bathroom fittings market was worth US$ 7220 Million in 2019. With sustained public and private measures in recent years, coupled with improving standards of living, the level of sanitation in India has increased manifolds. These measures have created a huge market for products utilized in the construction of public sanitation facilities as well as domestic bathrooms and toilets, namely, tiles, bathroom fittings and sanitary ware.

Government Initiative

Rapid urbanisation, distinct government initiatives like the building of smart cities, focus on housing for a larger segment of the society, Swachh Bharat Mission among others are major aspects for the overall growth of the sanitaryware market in India.

Scope for Investors in India

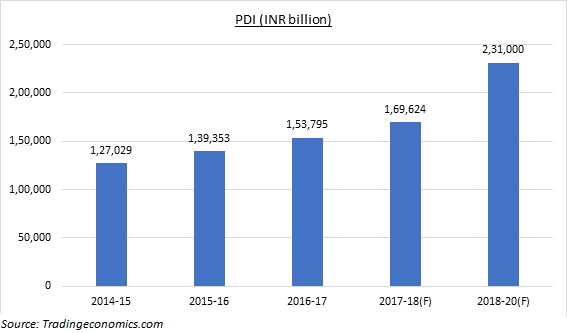

The Indian tiles, sanitary ware and bathroom fittings market was worth US$ 7220 Million in 2019 is further projected to reach a value of US$ 10,480 Million by 2023, at a CAGR of around 10% during 2019-2023. The change in preferences of consumers, rising personal disposable incomes, shift towards nuclear families, improved standard of living, especially in urban regions of the country, is expected to positively influence the India ceramic sanitary ware market as it is adding to the demand for housing and in turn, for sanitaryware. The demand for sanitaryware product is high in developing nations due to rising need for sanitation which makes it a favourable market for investors to earn huge profit.

INCUBATION CENTRES & STARTUPS

Overview on the industry

An incubator is a ‘facility that aids the early stage growth of companies by providing rental space, shared office services and business consulting assistance’. Incubation, as we know now, found its way into India around 1991. The germination of ‘incubating’ innovation-driven entrepreneurship in India can be linked to setting up of incubators in some of the eminent institutes of higher education in the country.

India, acknowledged as one of the hotbeds of entrepreneurship, is known to have well over 20000 start-ups across various domains and focus areas. In 2019, over USD 65 billion was invested in about 1800 rounds in start-ups in India; this was about 4% and 6% of the global investment amount and number of rounds, respectively. The development of Incubation centres holds significant importance in a country like India where entrepreneurs by the score are launching new setups and changing the game of business by minutes.

Government initiative to promote the industry

With the goal of promoting innovation and entrepreneurship, the State government has collaborated with premier institutes like IIT-Kanpur, IIT-BHU, IIM Lucknow (Noida), KNIT Sultanpur to establish Incubators. Also, to give an impetus to the start-up ecosystem in their respective states, the government has initiated new programs that include iStart Nest Incubator in Rajasthan, Kerala Start-up Mission (KSUM) and Maker Village in Kerala, Centre for Incubation and Business Acceleration (CIBA) in Goa, International Centre For Entrepreneurship and Technology in Ahmedabad, SRIJAN in Indore, Zone Start-ups India and a few others. Initiatives taken by the government to push incubation centre • About US$ 1.33 Billion approved by the Cabinet and established by Department for Promotion of Industry is being managed by SIDBI (Small Industries Development Bank of India) to provide a much needed boost to the Indian Start-up ecosystem. • Aspire - A Scheme for Promotion of Innovation, Rural Industries and Entrepreneurship – was launched by Ministry of Micro, Small and Medium Enterprises. It aims to set up a network of technology centres and to set up incubation centres to accelerate entrepreneurship and to promote start-ups for innovation in agro-based industries. Atal Innovation Mission – To support the establishment of new incubation centres called Atal Incubation Centres (AICs) that would nurture innovative start-up businesses in their pursuit to become scalable and sustainable enterprises.

Scope for Investors in India

As per extant Foreign Direct Investment (FDI) policy, FDI up-to 100% under the automatic route is permitted in the country. India offers rich business opportunities and markets to non-resident Indians (NRIs) for new products and services as it is one of the fastest, easiest and lucrative investment destinations in the world to set up business. India is the second-most profitable destination, according to UNCTAD's World Investment Prospects Survey 2010-2019. Today, a number of incubation centres are set up all around the country to improve small scale businesses efficiency in all sectors. It is further estimated that all the incubators help to graduate about 500 enterprises every year and out of these, 60 per cent are technology based start-ups making it the best time for investors to enter the market.

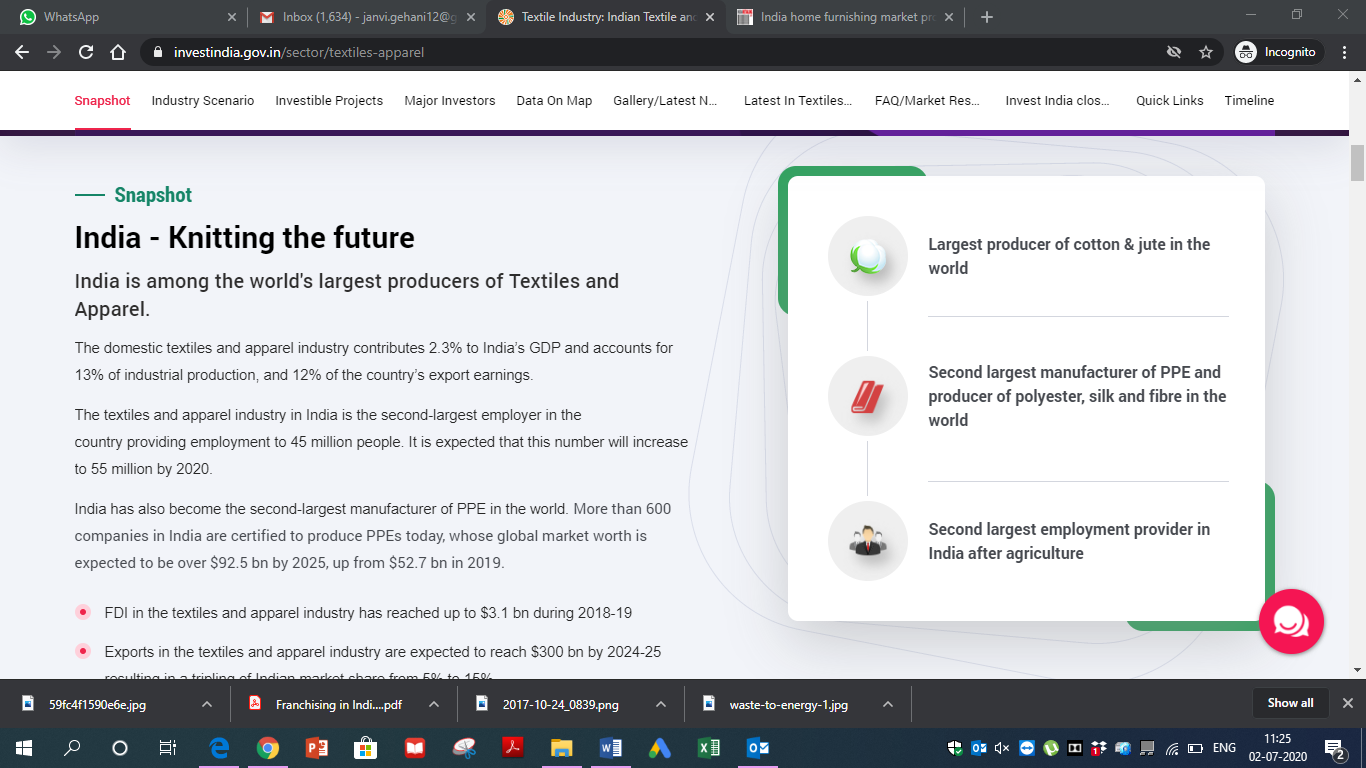

TEXTILE & GARMENTS INDUSTRY

Overview on the industry

Textile is a term widely used for referring to woven fabrics, yarns, and fibbers made from jute, polyester, cotton, wool, etc. In India, the textile and apparel industry is one of the oldest industries that has witnessed numerous developments over the years. The Indian textiles industry is extremely varied, with the hand-spun and hand-woven textiles sectors at one end of the spectrum, while the capital-intensive sophisticated mills sector at the other end of the spectrum. The decentralised power looms/ hosiery and knitting sector form the largest component of the textiles sector.

It has around 4.5 crore workers employed in textiles sector including 35.22 lakh handloom workers all over the country and contributes 2.3% to India’s GDP and accounts for 13% of industrial production, and 12% of the country’s export earnings. Today, the textile and apparel market has become a vital contributor to the Indian economy. This can be attributed to the abundant availability of raw materials used for manufacturing apparel such as cotton, silk, wool, etc. The Indian textile and apparel market was worth US$ 102.2 Billion in 2019.

Government initiative to promote the industry

The Indian government has come up with a number of export promotion policies for the textiles sector. It has also allowed 100 per cent FDI in the Indian textiles sector under the automatic route. Initiatives taken by Government of India are: • The Government of India announced a Special Package to boost exports by US$ 31 billion, create one crore job opportunity during 2020-2022. It has taken several measures including Amended Technology Up-gradation Fund Scheme (A-TUFS), scheme is estimated to create employment for 35 lakh people and enable investments worth Rs 95,000 crore (US$ 14.17 billion) by 2022. • Approved Integrated Wool Development Programme (IWDP to provide support to the wool sector starting from wool rarer to end consumer which aims to enhance the quality and increase the production.

Scope for Investors in India

The Indian textile industry is seeing a positive growth not only in the domestic market but also in the international market. Currently, India has a share of around five per cent in global T&A trade, which stood around $765 billion in 2019. The market is projected to reach US$ 225.7 Billion by 2024, growing at a CAGR of 14.2% during 2019-2024. Due to the high abundance of raw materials coupled with cheap labour costs, the cost of manufacturing textile and apparel is significantly lower than many other competing countries. In today’s scenario, the Indian textile industry stands a chance to gain in a big way from the global and domestic opportunities by exploiting the favourable business environment being developed in the country.

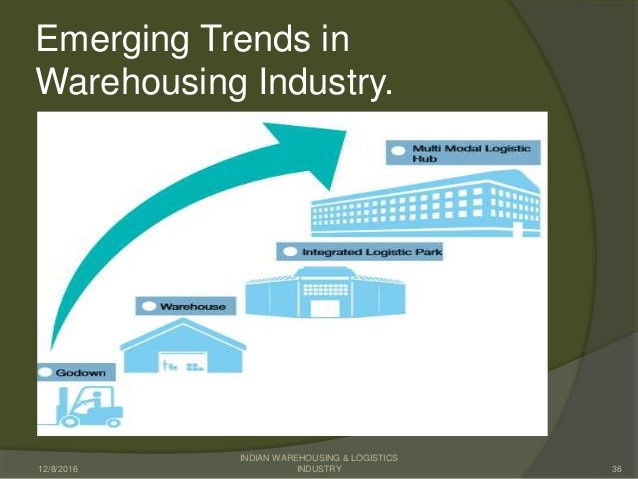

WAREHOUSING INDUSTRY

Overview on the industry

Logistics and warehousing plays an indispensable role in the transportation of goods across the country. A warehouse is a fundamental part of business infrastructure and is one of the key enablers in the global supply chain. The size of the Indian warehousing industry, across verticals, is estimated to be around Rs.560 billion. While warehouses dealing with agricultural and horticulture products account for about 15% of the total warehousing industry, cold storages have a share of about 16%. It’s the warehouses catering to the industrial and retail players that hold the maximum share, at 55%.

With the changing business dynamics and the foray of third party logistics in the sector, the growth story has begun and is still continuing. India’s warehousing requirement is expected to grow from 919 million sq ft in 2014 to an annual average rate of nine per cent to 1,439 million sq ft in 2022. Today in the Indian logistics industry, the warehousing sector is witnessing a great boom. Warehousing companies in India are increasing their capacity, expanding their network, adapting new concepts to match up with international standards and at a growing rate of 35-45 per cent every year and is expected to grow more than $20 billion by 2021. The size of individual warehouses is also growing and they are now becoming cargo hubs to store goods for multiple clients. The other benefit of multi-client sites is that all goods inside a warehouse are managed by one contract manager. It allows various users of a warehouse to leverage their resources, as a lean period for one user could be the peak period for another and therefore these sites are a favourite with large corporate houses.

Impact of GST on the industry

GST has also played a pivotal role in enhancing the growth of the Multi Modal Logistics Park (MMLP), due to which around 25 new MMLPs were developed. Warehousing and logistics have emerged as one of the biggest growth areas post GST. Major impact of GST implementation on warehousing in India can be summarized as: 1. Reduction or elimination in number of small-time, inefficient, high cost warehousing 2. Logistics: With companies opting for one or two major warehouses, the logistics moved towards hub-&-spoke model, wherein bigger but fewer trucks moved cargoes between manufacturing units & warehouses. 3. Technology: warehouses are bigger in size with huge inventory at a central location. Warehouse Management Systems (WMS) and modern robotics would get adopted for large warehousing hubs. 4. Costing: With lesser number of tolls and check posts, businesses have overall cost benefits. Reduction in total number of warehouses and automation of large ones helped companies to have streamline distribution, improve efficiency and save costs. The major beneficiaries have been E-commerce, consumer electronics, automotive, pharmaceuticals and FMCG players who now own or lease larger warehouses at major locations such as Mumbai, Delhi, Indore, Chennai, etc. Fewer stocking points will free up inventory.

FDI Investments Policy

Government has put in place an investor friendly Foreign Direct Investment (FDI) policy, under which FDI, up to 100%, is permitted, on the automatic route, in warehousing and food storage facilities.

Scope for Investors in India

As India evolves as an economy, sophisticated logistics and warehousing systems would be a key trigger for the manufacturing sector and the entire gamut of trade activities. A few growth drivers that work in favour of the country are - • Make-In-India: With the government thrust, there has been an accelerated growth in the manufacturing sector, particularly in areas like Textiles, Pharmaceuticals, Telecommunications, Automobiles and Food and Beverages making the need to have big warehouses all over the country • Enhanced Trade: Apart from manufacturing, sectors like organized retail, information technology, telecommunications, and healthcare have evolved dramatically over the last few years, driving consumption and thus a strong demand, leading to growth of warehousing. • Superior Technology and Digital India: With a wider internet penetration, technology enabled growth drivers like automation, real time tracking, RFID for automated data collection and stock identification are becoming increasingly popular, even in warehouses in tier 2 cities and metros. • Further, the modern Warehouse Management Systems (WMS) and other IT driven solutions, help create a sophisticated and efficient warehousing network that provides integration with automatic material handling equipment, cross-docking, yard management, labour management, billing and invoicing, etc.

WELLNESS INDUSTRY

Overview on the industry

In India, wellness is a concept which has been in vogue since ancient times. Traditional medicinal and health practices like Ayurveda and yoga have propounded the concept of mental and bodily wellness. With the progress of time, wellness as a concept has taken up a multi-dimensional definition, encompassing the individual’s desire for social acceptance, exclusivity and collective welfare.

Wellness players, thus have responded to this change, shifting their focus from traditional offerings like curative healthcare and value oriented mass products to new generational offerings like preventive healthcare, luxury products and personalized services. Growing consumer awareness, increasing disposable incomes and a desire among the millennial population to transform their lifestyles for the better has given the wellness sector across the world an unprecedented boom. Another domain which fuelled the growth of wellness was the spa industry, and it continues to rise at a phenomenal rate. From INR 85,000 crore in 2014-15, it is predicted to reach INR 1.5 trillion by 2020 (FICCI). Riding high on a demand for more than beauty services, the spa industry is now providing holistic treatments that pave the way for growth in the industry, drawing regional as well as international players.

Government Policies & FDI Investments

As per Indian government recent FDI polices, up to 100 percent FDI is permitted under the automatic route in the wellness and healthcare sector. The Government has also set the Ministry of AYUSH (Ayurveda, Yoga and Naturopathy, Unani, Siddha and Homoeopathy) with the aim of providing a boost to these ancient healthcare systems with a targeted thrust as the demand for Ayurveda, Yoga, Naturopathy, Unani, Siddha and Homoeopathy (AYUSH) and herbal products is surging in India and abroad.

Opportunities for Investors

India demonstrates all the demographic advantages of an ideal market for leading international spa and wellness brands as for long, the traditional segment of curative healthcare has dominated the market share and these continue to rule the roost as far as business opportunities are concerned. With predictions for the wellness industry positing a positive outlook, there is immense scope for businesses to make the most of the forecasts. There are opportunities to be explored in the industry across segments as well as in newer markets such as luxury spas, well fashion, and wellness tourism, particularly in semi-urban and rural areas. There is immense scope for innovation and expansion as the market share grows across fitness, healthy food and nutrition and the alternative therapy segment.